Income tax calculator for retired person

For instance lets take the example of the 2017 tax brackets and rates. Individuals Firms companies etc.

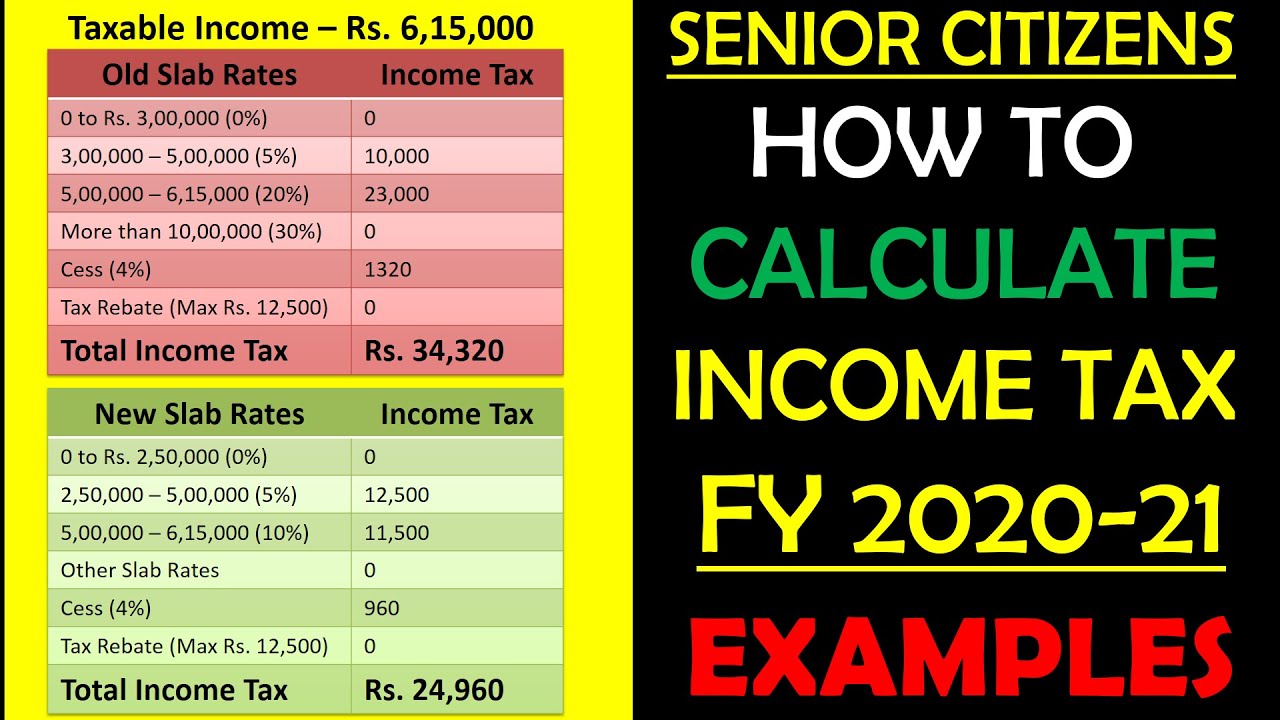

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Ad Use Our Retirement Advisor Tool To Help Determine Your Retirement Income Goals.

. Individuals who have opted to be taxed under the Allowances Based System will pay tax on their taxable income assessable income less allowances at the following rates. Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. The income tax calculator is available for quick and easy access to basic tax calculation for the public.

Assessment Year AY 2021-22 and FY 2021-22 AY 2022-23 applicable to various categories of persons viz. One of the most important assumptions is the assumed rate of real after inflation investment return. 1800-258-5899 9 am to 6 pm.

For instance Georgia does not tax Social Security retirement benefits and also provides a deduction of up 65000 per person on all other types of retirement income. Retired heads of household age who earned less than 20500. Ad Its Time For A New Conversation About Your Retirement Priorities.

It does not assure the taxpayer for an exact payable tax. The more someone makes the more their income will be taxed as a percentage. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

No matter what method you choose your 2021 income tax return is due April 18 2022. The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount. TIAA Can Help You Create A Retirement Plan For Your Future.

For a single person making between 9325 and 37950 its 15. For those with an income below the listed thresholds you may not have to pay taxes. You may also use the Tax Calculator for Resident Individuals XLS 96KB to estimate your tax payable.

This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years. Find tax rates for 2022-23. Rates of Income Tax for Financial year FY 2020-21 ie.

Any amount received as a gratuity by an employee shall be treated as income of such person under the head Salaries. Roughly speaking by saving 10 starting at age 25 a 1 million nest egg by the time of retirement is possible. For instance a person who makes 50000 a year would put away anywhere from 5000 to 7500 for that year.

Missouri offers the following filing options. This is often used for a second job or pension. If you want to avail income tax benefits on life insurance policies click the button below to get started in a few easy steps.

Introduction This article summarizes Tax Rates Surcharge Health Education Cess Special rates and rebaterelief applicable to various categories of Persons viz. Only the highest earners are subject to this percentage. Youre not entitled to any tax-free personal allowance and all income is taxed at the 40 higher rate 21 intermediate rate in Scotland.

2-D Barcode Filing Filing your state paper return using a barcode. If you choose to file a paper return you can use. These two taxes are called as FICA tax.

Non-resident tax rates Taxes on employment income. As announced in the 2019 Union Budget women taxpayers in India with a total income of up to Rs. Income Tax Exemption on Gratuity.

Please refer to How to Calculate Your Tax for more details. Retired qualifying widowers who earned less than 26450. The preceding provisions of this Paragraph shall be increased by a surcharge at the rate of fifteen percent.

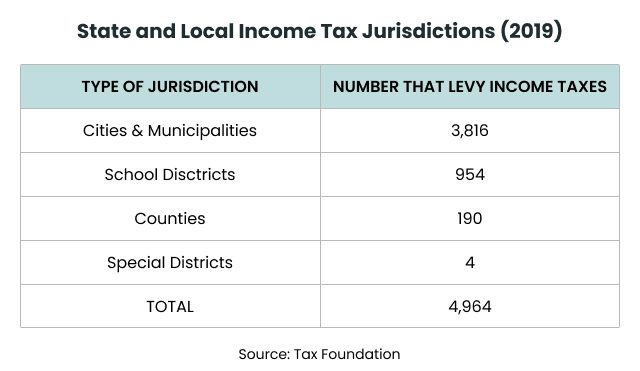

Dont Wait To Get Started. In 2022 the federal income tax rate tops out at 37. Employment income of non-residents is taxed at the flat rate of 15 or the progressive resident tax rates see table above whichever is the higher tax amount.

To calculate your tax liability click on the Gross Income Based Tax Calculator. Moreover the exemption would not be allowed on policy benefits received under a Keyman insurance plan under Section 80 DD 3 or under Section 80DDA 3 of the Income Tax Act 1961. RM600000 of additional personal tax relief if an individual is disabled and tax.

The good news is you only pay 10 on all income up to 9325 then 15 on income up to 37950 and so on. Enter the tax relief and you will know your tax amount tax bracket tax rate. Retirement calculators vary in the extent to which they take taxes social security pensions and other sources of retirement income and expenditures into account.

But even if you dont have to file your taxes its usually your best interest to file anyways. The first 4000 of taxable income 16 the next 12000 of taxable income 19 balance 41. The Government of India also provides income tax rebate for women available in accordance with Section 87A of the Income Tax Act 1961.

Paper Short Forms - MO-1040A. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Paper Long Form - MO-1040.

Social security taxes are for the benefits of the retired person or disabled person or for their dependents. Additional personal tax relief is also given if a person is disabled or married to a disabled person. D1 or SD1 or CD1 Youre not entitled to any tax-free personal allowance and all income is taxed at the 45 additional rate 41 higher rate in Scotland.

Ad Get Personalized Action Items of What Your Financial Future Might Look Like. Buy Insurance Plans Now. Find out the latest Income Tax Slab Rates for taxpayers as per the new Union Budget 2022.

Also in Pennsylvania all Social Security benefits and IRA and 401k income is exempt. A single person making between 0 and 9325 the tax rate is 10 of taxable income. A tax planner tax calculator that calculate personal income tax in Malaysia.

Income Tax Slab 2017-18. 2016-17 for Individual HUF AOP BOI Partnership Firms LLP Companies. Know More about Income Tax Slab.

Eligibility how to calculate income tax exemption and other details Employers not covered under the Payment of Gratuity Act 1972. However in case of the death of such an employee the. Electronic Filing e-filing of your state and federal return.

The assumptions keyed into a retirement calculator are critical. Income Tax Slabs Rate Chart for Assessment Year 2017-18 FY. New Income Tax Slabs.

Of such income-tax in case of a person having a total income exceeding one.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

Personal Income Tax Brackets Ontario 2021 Md Tax

Income Tax Definition What Are Income Taxes How Do They Work

Ontario Income Tax Calculator Wowa Ca

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

2021 2022 Income Tax Calculator Canada Wowa Ca

How I Retired At Age 30 With 500 000 Saved Personal Finance Advice Early Retirement Budget Advice

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Income Tax On Pension How To Calculate Tax On Pension Is Pension Taxable Or Exempt Family Pension Youtube